The Rise and Fall of Litxbit.com: Understanding the Notorious Crypto Scam

In the murky world of cryptocurrencies, scams come and go, often leaving investors with perpetrated losses and a trail of shattered trust. One such infamous case is Litxbit.com, a ponzi scheme that duped thousands of people into parting with their hard-earned digital cash. In this article, we’ll delve into the story of Litxbit.com, examining its inception, tactics, and aftermath to shed light on the warning signs that can help prevent similar scams in the future.

Bulgarian Roots and Expansion

Litxbit.com, registered in 2017, was initially an exclusive Bitcoin (BTC) investment platform, claiming to provide cryptocurrency trading, mining, and other services. Spearheaded by a group of Bulgarian entrepreneurs, the company’s early success in its home country led to expansion into international markets, attracting an influx of enthusiastic investors. The scheme’s allure was further amplified by the so-called “golden age” of 2017, when Bitcoin’s value skyrocketed, making it seem like a wise investment.

The Scam’s Charming Pitch

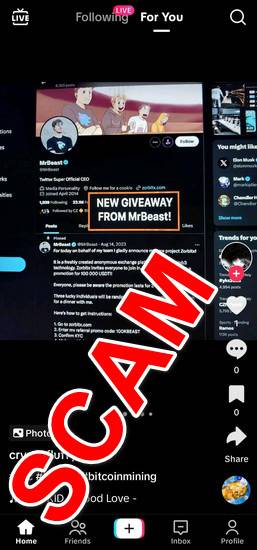

The perpetrator’s key strategy was to create a fascinating narrative around the platform’s supposed cutting-edge technology, emphasizing the benefits of diversifying investments and providing returns that were far higher than those of traditional markets. To entice investors, Litxbit.com offered an impressive range of “investment packages” with alluring returns, often accompanied by sensationalist marketing campaigns and celebrity endorsements. Newcomers were lured in with promises of rapid returns, convincing them to invest a portion of their cryptocurrency reserves.

Red Flags and Warning Signs

As the scheme unfolded, several red flags became evident:

1. **Lack of Regulatory Compliance**: Litxbit.com failed to comply with basic regulatory requirements, operating without the necessary permits or licenses in most countries.

2. **Unsubstantiated Claims**: The platform made impossible promises, such as guaranteed high returns and elaborate trading strategies, without providing concrete evidence.

3. **Insufficient Transparency**: Investors were given little insight into the operational details, such as asset allocation, financial statements, or profit/loss distributions.

4. **Unqualified Founders**: Central figures behind the operation were not experts in finance, cryptography, or technology, raising concerns about their ability to deliver on their promises.

The Meltdown and Legal Consequences

As the scam unraveled, investors began to question the legitimacy of Litxbit.com,